The Token Name Service

A single, global,

asset namespace

Live tickers from the TKN Registry

Imagine a single registry encompassing all of the tickers on earth. As builders and true believers in crypto's disruption of global finance, we must prepare for exponential tokenization

with

a predictable, composable, and community owned registry. An onchain registry to cure the fragmentation of both tradfi and crypto, while solving the problem of centralized token lists in DeFi.

This system must be so easy to use, that any

developer can query it. It must be simple enough that any PM can understand it. It must be reliable

enough

that it will run for multiple lifetimes, and it must be decentralized, so that it

always

helps the little guy.

It's time to build an overlooked but crucial piece of the defi stack, together.

Table of Contents

Overview

What is the Token Name Service?

TKN is a name service protocol for allocating token symbols onchain. Some well known token symbols include: $BTC, $ETH, and $USDT. Additionally, the protocol is tasked with maintaining accurate onchain metadata, and putting it all in the hands developers.

Why a Name Service for Tokens?

$OBJECT

Token symbols are a unique and exciting primitive, that can only reach their full potential through an ambitious decentralized protocol.

As a namespace, token symbols have unique needs compared to traditional domain names:

- Symbols are granted, not purchased. The namespace serves developers and users instead of name owners primarily

- Empirical allocation criteria are required to prevent namespace pollution

- A security model is required to ensure metadata accuracy

What are the current industry shortcomings?

- All apps currently use centralized token lists

- Many protocols such as bridges and DEXes require a centralized Coingecko or CEX listing as a prerequisite

for

token inclusion

- Scammers can easily impersonate legitimate tokens with duplicate tickers

- The token landscape is currently fractured among many tools and ecosystems. Few developers

incorporate

the entire dataset.

The DeFi stack

DeFi Legos

Decentralized finance is a stack of independent protocols that work in concert to create unstoppable financial infrastructure. The DeFi stack is a revolutionary achievement.

However, it has a remaining point of centralization: the token list.

Why is this important?

Most centralization takes hold when the stakes are low; before its pernicious effects are felt. The network effects of centralization can take decades to overcome, if ever.

The DeFi stack

is only as strong as it's weakest layer.

Completing the DeFi stack

In the following whitepaper we will cover

- How to wisely allocate scarce token symbols

- How to expand the purview of crypto to global infrastructure

- The technical foundations of the Token Name Service

- The list of accompanying developer tools and end user products

- The swp.eth "headless" DEX

- Protocol and crypto industry growth objectives

- The TKN DAO constitution, rules, and responsibilities.

- $TKN pre-launch airdrop allocations

TKN would like to solicit feedback from the community on this document during the Pre-Launch period. Please submit specific feedback and ideas for this whitepaper here.

Protocol Overview

Ticker Symbol Supply

Is a single namespace sufficient for all of global finance?

The following computes the available quantity of tickers:

Summation to compute the available quantity of token symbols

Available token symbols by ticker length:

c: 1 - 26 tickers

c: 2 - 676 tickers

c: 3 - 17,576 tickers

c: 4 - 456,976 tickers

c: 5 - 11,881,376 tickers

c: 6 - 308,915,776 tickers

c: 7 - 8,031,810,176 tickers

c: 8 - 208,827,064,576 tickers

c: 9 - 5,429,503,700,000 tickers

c: 10 - 141,167,100,000,000 tickers

The supply of token symbols is practically infinite:

Total Available Tickers

Estimated number of Atoms in the known universe

Current number of stocks, globally

Estimated current number of crypto assets

A single namespace is a virtually unlimited resource, and ample to power a global ticker protocol.

Allocation Curve

We've shown that a single namespace can support the world's assets, but how do we allocate scarce, shorter symbols?

The ticker allocation curve increases the listing criteria required as a namespace becomes more scarce, reserving symbols for important future assets.

As symbols get more scarce, the Listing Criteria increases

For short, scarce, symbols, ($XX) the Listing Criteria will rise quickly. For longer, plentiful, symbols, ($XXXXXXX+) the listing criteria will rise more slowly or never.

Notation:

- Economic Upper Bound: Equal to the most valuable asset in the namespace during calculation.

- Listing Threshold: A minimum initial curve value for scarce ticker lengths. (1 & 2 character symbols)

- Listing Criteria: Total asset value required to claim a symbol at that character length.

- u - Target Utilization: A defined target to reserve token space for strategic action. (0.8 = 80% of the namespace is active in the curve.)

The precise curve will be a function of the power law of token valuations.

Incumbency

All currently existing crypto projects above a $10MM market cap will be granted their tickers regardless of fitness.

Delisting Criteria

If a project becomes inactive and falls below the value criteria (liquidity, market capitalization), it enters a probationary period, by which the project has a period of time to re-meet the minimum criteria.

Upgrading

A token that starts out with a longer ticker, and increases in value is eligible to upgrade to a shorter, prestige ticker. For continuity, the entity will be allowed to retain it's former, longer, ticker.

Non-ASCII characters

Non-ASCII character normalization via ENSIP-15 unlocks additional supply and expressiveness in the TKN namespace.

The inclusion of Non-ASCII characters in the namespace increases the ticker supply exponentially. An extrapolation of the Non-ASCII domain supply can be found here.

Dataset

TKN will maintain an onchain meta-dataset for each token (name, contractAddress, url, Twitter, ect.)

-

Submitting Data

Any user can, and is encouraged to, submit a data update or correction. Allowing anyone to submit edits will increase scrutiny and maximize data accuracy. The contributor may be rewarded in $TKN.

Validating Data

Elected delegates validate user submitted data for accuracy. After a 24 hour observational period, the update is migrated onchain.

Data Overrides

If a quorum of $TKN holders disagree with a specific datapoint, an onchain vote can be held to override the data.

An onchain vote will modify the contract state, and is the supreme enforcer of tokenholder's rights.

Securing Data

Curators can stake $TKN to validate and signal their confidence in the metadata for a token, similar to theGraph's staking model. If the staker's data is accurate, they will generate a yield. If it is incorrect, their stake will be slashed.

The Protocol

A living document will be published onchain, with operating procedures that govern the Token Name Service. It is an important living document, and one of the main governance features for TKN. Changes to the protocol directly affect the mechanics of the TKN namespace.

Protocol Objectives

- The power of a single, global, asset namespace is to elegantly deliver a snapshot of humanity's economic activity to a single developer's fingertips.

Now is the optimal time to launch

a single, global, asset namespace.

- Prevent ticker name collisions, which cause economic drag in the DeFi stack

- Design for immortality. Unlike a centralized product, TKN should be aspirationally designed to run for multiple lifetimes, without human intervention.

Protocol Vision

Put simply, to become the decentralized Standard & Poor's (S&P). To securely incorporate an expanding dataset. To disrupt the traditional financial caste system, and allow underprivileged projects access to capital markets and infrastructure.

- Expand the scope of tracked assets

- Expand the types of data tracked. Push the type scope outward to expand the secure dataset available to developers

Technical Overview

Abstract: TKN is a protocol layer hosted on top of ENS that inherits it's distribution, tooling, and security.

The TKN → ENS → Ethereum stack

The TKN → ENS → Ethereum stack

Underlying the TKN Protocol is the ENS domain tkn.eth.

All token symbols are persisted on the Ethereum L1 as subdomains of tkn.eth. For example: the contract for USDC can be found at

usdc.tkn.eth

and Wrapped Bitcoin at

wbtc.tkn.eth. Each subdomain points to the ENS Resolver contract, where the token metadata is stored.

The resolver maintains a rich onchain dataset for each symbol, which includes:

Name, description, avatar, url, notice, contractAddress, decimals, twitter, github, dweb, version, sidechain & non-EVM contract addresses.

Detailed documentation for the dataset can be viewed

here.

A json array of token symbols is persisted at registry.tkn.eth, which serves as the namespace's source of truth.

Querying the dataset onchain

Detailed developer documentation can be viewed here.

A developer can query the TKN helper contract to fetch all metadata at once, or query the ENS resolver to fetch individual data points.

This namespace and data can be resolved anywhere that an Ethereum RPC or ENS is supported, it can also be queried from any developer library that supports ENS.

TKN can be queried from any tool or lauguage that supports ENS

TKN Subgraph

TKN has a GraphQL subgraph, that can return the entire dataset in one convenient HTTP query.

TokenList

TKN maintains a tokenlist that conforms to the industry standard: TokenLists.org

The tokenlist is published at list.tkn.eth

Decentralized Token Websites

The decentralized web (websites with redundant, uncensorable hosting) is an ascending feature in the crypto ecosystem. Many token projects are publishing their frontends as decentralized websites, to make their protocols fully unstoppable. Read more about decentralized web resolution in EIP1577. As a part of the TKN metadata, any tokens with decentralized websites will resolve from their respective subdomain. For example: weth.tkn.eth for $WETH and snx.tkn.eth for $SNX. If your browser doesn't yet support the decentralized web, add .limo to the end of the domain: 1inch.tkn.eth.limo.

Technical Objectives

Now is the perfect moment to launch a single, powerful, ticker namespace and prevent long term technical fragmentation by geography and industry

- Decentralization is paramount. Every bit in the TKN stack is decentralized. Token metadata lives onchain, token logos are hosted on IPFS, and the TKN explorer is a decentralized web app.

- The Ethereum L1 is the most highly valued and secure state machine. Instead of looking elsewhere for cheaper fees, TKN will purposefully embrace the ETH L1.

- Persisting on L1 will allow contracts on L2s to observe and consume the TKN state.

REMOTESTATICCALL will enable this in the OP stack.

Technical Vision

- Integrate TKN Protocol into EVM developer tooling

- Continuously publish the TKN dataset from the Ethereum L1, to L2s and sidechains, for onchain consumption

- Support TKN integration on non EVM protocols

- Investigate persisting periodic cryptographic proofs to Bitcoin, in addition to the Ethereum L1 state

- Develop tooling for wallet developers, including a substream graph to index user token balances in a decentralized manner

Product Overview

An overview of products that are both enabled by the protocol, and contribute to it's operation:

TKN Application

tkn.xyz or (tkn.eth) is an internally developed, decentralized application that makes it easy to interact with the protocol, and serves as a reference implementation for developers. While TKN is decentralized and can be added to any product, the reference application enables features:

Decentralized Token Tracker

The token leaderboard and price tracker is an institution in crypto. Now users can check prices and manage their portfolio from a community owned token tracker. Since the data sources are decentralized, users aren't locked in to a particular product.

Composability & Portability

The TKN reference app provides an opportunity to develop an open portfolio standard. When a user favorites a token, a portfolio singleton can be saved, which can be consumed by other portfolio trackers and other products.

Metadata editor

Inside the TKN application is a full featured token metadata editor. If a user encounters a data discrepancy, they can easily tap the edit button, and submit a revision for validation. No more will be be passive data consumers. The open TKN dataset will benefit from the eyeballs of the entire ecosystem.Allowing anyone to submit edits will increase scrutiny and maximize data accuracy.

Mobile App

The TKN mobile app is live in the iOS app store. With Android coming soon. It's the most convenient way to get TKN data, and the only token tracker that you can have ownership in.

60% of the world's internet traffic is from mobile devices. In Africa, the mobile web share is 70%. Internet Traffic from Mobile Devices (Aug 2023)

The future of crypto is mobile. Publishing a mobile app enhances the reach of the TKN protocol, and accelerates crypto's mission of hypertokenization.

Decentralized Websites

With the growth of the decentralized web, more and more token projects are publishing uncensorable websites & apps. A major shorcoming of the current DWeb is that it's difficult to locate the source for the decentralized website for your token. With TKN all you need to know is the symbol for the project.

With TKN, DWeb is easy. When you want to view the DWebsite for a token, just add the token name to tkn.eth. For example, Uniswap can be located at uni.tkn.eth.

Note: If your browser doesn't yet support DWeb, just add .limo to the end of the url and it will resolve. Example: uni.tkn.eth.limo.

Developer Documentation

Developers are the lifeblood of a protocol. Enhancing the developer canvas is the primary directive of the Token Name Service. Documentation is a top priority for the DAO's product development effort. TKN will strive to make it's developer docs a north star in the industry. The TKN docs can be viewed at docs.tkn.xyz

Product Roadmap

- Persist Web2 tickers in a complementary namespace onchain to create a unified interface

- Publish tooling with world class UX to resolve decentralized websites on Mobile and Desktop devices

Product Vision

- Maintain and expand tooling that makes it dead simple for projects to register their very own ticker

- Integrate .tkn resolution into developer tooling

- Develop product to benefit web2 and expand the purview of DeFi

Roadmap

Pre-Launch

TIP-0: TKN

This whitepaper shall be considered the first TKN Improvement Proposal. (TIP) A request for comment on the TKN Protocol itself. This RFC will take place concurrently with the pre-launch airdrop to encourage community participation.

- Drop $TKN to developers and governance participants

- Allow a technical comment and diligence period

- Bootstrap governance processes

Product Roadmap

- Etch all tokens above 20MM market cap onchain

- Decentralized substream token balance API for wallet and app developers

- Add token discord links to official dataset

swp.eth

The best user interface is no interface at all.

The most uncensorable UI, is no UI whatsoever.

Having a highly scrutinized onchain token database affords TKN something unique; guiding swaps using just a domain name.

What is SWP?

Swp.eth is a "headless DEX". When a user sends $eth to usdc.swp.eth, $usdc is automatically returned in the same transaction.

Thus, no UI or user inputs are required.

Benefits

- Perform swaps from any wallet, no web3 browser required

- Resist censorship imposed by frontend UI developers

Why does this work?

SWP Contracts observe TKN's onchain state. Thus when TKN is updated, SWP is updated. As such, SWP inherits the scrutiny and confidence of the TKN Protocol.

Can devs integrate SWP into their smart contracts?

Absolutely! By integrating SWP, developers don't have to worry about the neverending ops required to maintain proper token pointers.

SWP is just the start of the intent based protocols enabled by onchain TKN data.

Revenue

While the default swap fee is 0.1%, protocol swap revenue can be modified by the DAO for each token pair

Revenue from swp will help steward the Token Name Service, and fund additional product development.

Rollout

SWP has launched with fifteen pairs: USDC, USDT, DAI, TKN, WBTC, wstETH, cbETH, rETH, LINK, PEPE, SHIB, MKR, UNI, ENS, WETH. More pairs will be rolled out until every token with liquidity is supported.

Additional roadmap items include erc20 → erc20 swapping, liquidity aggregation, and L2 support.

Interfaces for additional intents will be published, including bridging, staking, short, long and others. Example: bridge.op.tkn.eth

Initial Deployed Pools

Additional routes

For users that prefer using the tkn.eth domain: swap.usdc.tkn.eth, swap.usdt.tkn.eth, swap.dai.tkn.eth, swap.wbtc.tkn.eth & swap.weth.tkn.eth, ect. perform the same swap function.

Conclusion

As the popularity of Telegram trading bots has shown, users value speed and convenience. As more of the ecosystem learns about swp.eth, we anticipate a substantial and permanent percentage of trades will be conducted via intentful interfaces such as swp.eth.

Growth

Asset Data Roadmap:

The following is an asset onboarding roadmap in approximate descending order of difficulty:

- EVM Tokens

- Non-EVM Tokens

- Sovereign currencies

- Major Equities

- Personal Assets

- SMBs

Growth Strategies

TKN growth strategies include, but are not limited to:

Referral Program

For each new listing, a DAO or individual can refer the ticker.

Rolling Airdrops

The pre-launch airdrop has outlined an initial, accretive, subset of ecosystems. On a periodic basis, TKN will bring the members of new ecosystems into the fold.

Metrics

- Impressions Per Day:

-

The number of times a TKN asset is viewed per day across all apps and platforms.

- Total Value Indexed:

-

The cumulative value of the market caps of all tokens/tickers indexed on TKN.

- Percentage Value Indexed:

- The estimated percentage of all human assets indexed by TKN. Total value of assets indexed by TKN / Total estimated market cap of all assets

- Updates per day:

- The average number of TKN datapoints updated per day over the prior 30 day period. Includes new and updated datapoints.

- Unique Contributors:

- The number of individual actors who contribute data, code, votes, or discussion.

- Ecosystem Diversity:

- The number of different technical ecosystems that have engaged with TKN. Examples include: Bitcoin, ENS, Cosmos, "Web2", TradFi, ect. Categories are subject to evolution.

- Number of Symbols issued:

- Total Symbols Issued: The number of token symbols allocated!

Endgame

The number of onchain entities required to connect the world.

The number of onchain entities required to connect the world.

Crypto's mission is to bring financial infrastructure to the world. A universally adopted crypto stack might necessitate roughly a dozen onchain entities per person. Entities can include token balances (assets, project shares, mortgages, stablecoins), identities, legal agreements, dwebsites, memberships, art, and other objects.

The adoption calculation is simple:

10^11 is the finish line. 10^11 pieces of onchain state are required to accomplish our mission.

TKN will accelerate adoption by building the product, tooling, onramps, and education to allow the world to tokenize, while maintaining strict decentralization. TKN will actively support the growth of other components, projects, and layers of the crypto stack to accomplish this goal.

DAO

Governing Principles

- If a protocol function can be safely decentralized, it should be.

- Noncontentiousness: TKN should be friendly and inclusive to the entire crypto ecosystem, tradfi, and the world.

- The TKN DAO will focus on it's mission to accelerate tokenization worldwide, and will not take public positions on social, or political issues.

Principles

- Large projects can fight for themselves, independent developers need someone to fight for them. TKN will nurture the independent developer and further decentralization.

- TKN is a QA organization. Every inch of product released should be reliable, polished, and exciting to use.

- Product development cadence cures all ills. An organization that quits shipping is dead.

- TKN will deliver an audacious product launch at least once a year.

- A focus on growth always trumps tokenomics in the long term.

- The org will prioritize projects that minimize governance effort.

TKN DAO

Responsibilities

- Maintain up to date tooling for each major language and environment

- Maintain the freshest dataset with the most updates per day.

- Conduct onchain votes for any protocol changes via Tally.xyz or similar tooling

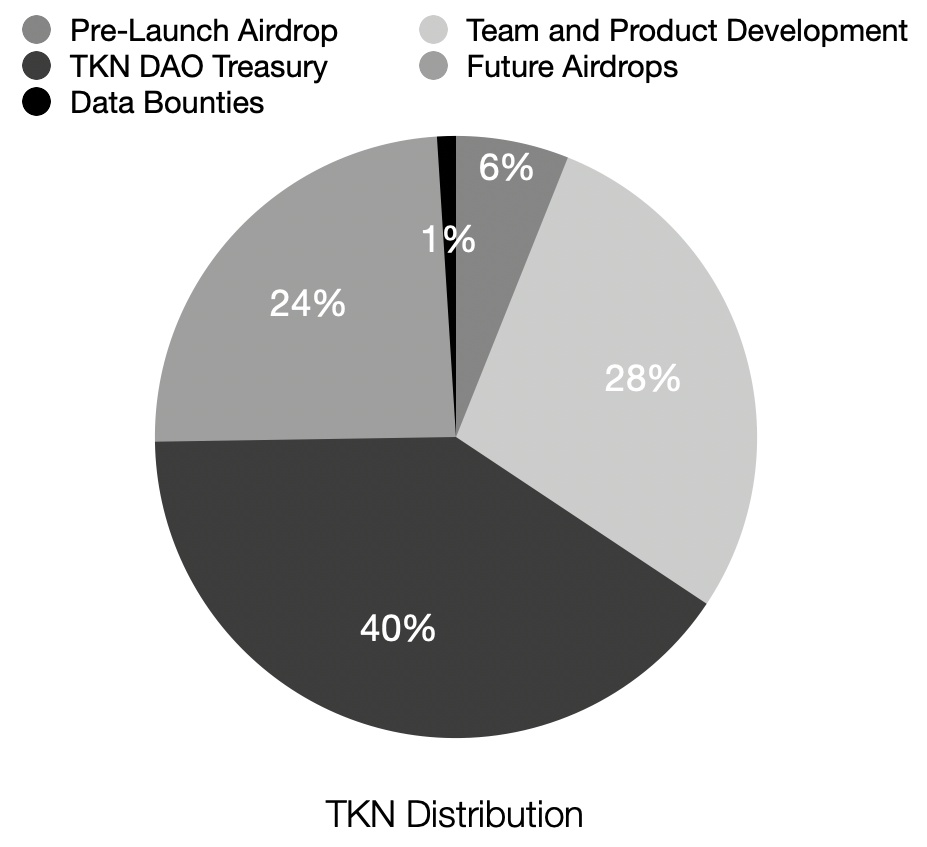

Pre-Launch $TKN Airdrop

TKN is pleased to grant pre-formation governance rights to core contributors in the crypto industry.

Referral program

Airdropping to an ecosystem’s active members is by nature, a capricious endeavor. To mitigate this, each

recipient will be able to choose one airdrop recipient to help TKN’s mission to decentralize crypto’s

ticker

namespace.

If you refer someone who receives a retroactive airdrop for a contribution in Airdrop 1

or

2, you will receive a 20% referral bonus.

*Airdrop referrals may be limited to the first 2000 recipients. *

Recipients

During the pre-launch period we aim to achieve a robust governance body with core contributors to Ethereum, Tooling, Defi, Wallets, general development, and the greater crypto ecosystem.

Due to the formative nature of the pre-launch period, substantial grants will be made retroactively to contributors during this phase.

If you've tweeted or posted publicly about tickers, nameservices, or other relevant topics somewhere in the past, contact us.

TKN is intended to be a protocol and token tracker that is owned it's users. To that end, airdrop 1 should be a wide ranging, and inclusive grant.

Future airdrops will be conducted to retroactively reward users and contributors, and further decentralize the protocol.

On a rolling basis TKN DAO may choose to allocate $TKN to additional ecosystems strategically.

1,000,000,000 TKN has been created with a hard cap.

“That which feels deeply familiar today was once a design choice of yesterday. What we know as ’normal’ is merely the status quo, and it can always be reshaped.” – Unknown

TokenDAO has been established to propagate a new name service- Token Name Service (TNS). By using TNS, tokens, assets, brands, companies, or communities can aggregate key data and multiple internet names under their own short and unique token symbol. This makes it easier to reach their products and services in various contexts like browsers and wallets. In today’s world, users access a variety of data, products, and services over the internet from a company or community on a daily basis. These include token addresses, token prices, web app URLs, community forums, social media accounts, GitHub repositories, code packages, logo images, and so on. A unique token symbol assigned to a token, a company, or a community can now become their single internet name and data aggregator for their users.

In this post, we discuss how TKN incentives and a simplified DAO work model can help token symbols be a more convenient way to access data, products and services.

Replacing internet names with unique symbols

Tickers are established data aggregators

The ticker is an established data aggregator in the financial world where users are familiar with companies based on their tickers on exchanges like NYSE and NASDAQ. In addition to providing access to financial data, tickers have become popular symbols for many companies. Ex. GME, BBB, QQQ. With TokenDAO, communities can establish presences for their well-known token symbols in the crypto token universe (for example, ETH, USDC, DAI, UNI, LINK, etc.) by making them unique within TNS, and helping communities store critical information on the blockchain, such as token addresses and official price oracles.

Token symbols are better than domain names

We think short and unique token symbols (tickers) are better alternatives not only for accessing financial data like token prices, but also for resolving web (or dweb) domains, too. Due to the uniqueness of token symbols and the ease with which they can be entered manually in a browser or wallet, they can be a better choice for internet users than regular ICANN domain names and decentralized ENS names. When users enter the full domain name uniswap.org, they may easily make a mistake and end up on a clone web app created by a scammer and lose money. It is now risky to search for highly recognized brands like Metamask or Uniswap on search providers such as Google. This is because scammers pick up the top ad slots to serve scam links. Getting to the right website without falling into scammers’ hands is getting harder every passing day. Token symbols like UNI for accessing the Uniswap DEX and VOTE.UNI for accessing the Uniswap governance portal from the browser navigation bar improve user safety. A scammer would never be able to purchase or own typos for UNI on TNS, such as UNL or UMI. Before any of their on-chain data or web app URLs are initialized within TokenDAO, each community must instantiate their token symbol using transparent governance processes. The TNS dataset is open, published on-chain, and updated with checks and balances, so at worst, users will be misdirected, but would never end up on blatant scams.

In order to make it easier for users to access their data and web properties safely and efficiently, tokens, brands, organizations, or communities should establish their own well-known short and unique token symbol within TokenDAO. As long as the main Uniswap project is active, TokenDAO will never let another project get the UNI token symbol within its dataset.

TNS will be censorship resistant and transparent

In a way, crypto is a revolution in transparency and composability; it rewards censorship-resistant conventions. TNS namespace and its dataset are hosted on blockchain-based virtual machines, which provide both censorship resistance and transparency - two of the most required features of any namespace. Namespaces stored on blockchain are the most secure - they will never be hacked by malicious actors, are always maintenance-free, and never become offline.

Token symbols should be assigned automatically by consensus

As a matter of common sense, everyone would agree that Google and the products it wants to market should be represented by the token symbol GOOG or the name GOOGLE. Getting a name or token symbol assigned for free from the TNS namespace could be enough to get a brand or community a secure presence online.

Users suffer real transaction costs when reaching their favorite product or service online due to mis-assigned names within any namespace (DNS or ENS). The burden on users increases if a domain is not used for the right purpose within a namespace. By selling premium names, domain squatters and TLD owners who won auctions a decade ago make a significant profit today. This is done by forcing brands to register multiple names to protect their brand across multiple TLDs to get online. TokenDAO standards and incentives now allow communities and companies to focus on establishing their products. They will always receive a free and unique token name or symbol relevant to them from TNS.

Swat the squatters

Token symbols are instantiated by TokenDAO and remain free forever. The removal of the need to purchase token symbols, and the assignment of them to brands and communities following their establishment, removes the entry points for squatters who normally enter with a low-effort name purchase from a name service.

As a result of the incentive system established by TokenDAO, participants are able to police the namespace and keep it free of name squatters. A namespace is a public good, and when managed as a public good, communities can focus on building their brand knowing that their preferred token symbol will be present for them without even having to pay a fee. Developing rules and incentives is necessary to help everyone police namespaces as public goods, remove name squatters, and make way for real brands and companies to get their desired names.

Free and unique symbols for autonomous assets and communities

With the advent of AI and crypto, the world is moving towards autonomous assets, organizations and services, many of whom need an internet identity, ephemerally or permanently, but do not have the infrastructure or trust structures which allow a single person to own or maintain a domain name continuously on behalf of the autonomous asset, organization, or service. Crypto makes it very easy to deploy autonomous services and assets that need minimal or no maintenance to exist forever. TokenDAO can easily allocate free names from TNS to serve these new types of future organizations and help give them an easily accessible and secure presence online.

TKN Incentives Model

TokenDAO incentive programs are primarily focused on compensating participants for the work that they do to monitor and maintain the TNS namespace and the on-chain dataset on behalf of the TokenDAO. To help work participants accomplish their work effectively and get paid for it while serving the needs of the TokenDAO ecosystem, we propose a governance model that cuts down on typical DAO bureaucracy. We present the following governance model as a draft for consideration and it can be operationalized after a broader round of feedback has been received from TokenDAO participants and individual organizations and communities wishing to have a presence within the TNS namespace for their assets and products.

No DAO proposals or voting

TokenDAO participants publish clear RFCs. Any service provider may request to take on one or more of these RFCs. All RFCs that have been accepted are placed into the next work cycle which lasts for 15 weeks. The goal is to maintain the TNS dataset, develop open-source products that will help TokenDAO enhance its network effect, and create open-source products that utilize the TNS dataset.

Work Cycle

A bucket for the distribution of TKN tokens for a single work cycle is created at the beginning of the cycle. TokenDAO seeds each bucket with TKN tokens and distributes shares to service providers according to their RFC bids. By the end of the cycle, service providers will be able to submit their work output to TokenDAO. Buckets would be automatically finalized at the end of the work cycle and payout the TKN held within them according to the percentage of shares each service provider owns. It is not possible for TokenDAO to cancel any of these payouts, regardless of the quality of the work performed by the service providers. TokenDAO can also add a percentage of revenue generated from paying customers to the bucket at the end of a work cycle so bucket share holders can receive an additional payout. TokenDAO participants can stake TKN to vouch for service providers and resolve contention for RFCs when multiple service providers vie over a single RFC.

Repeated Games

Service providers working on an accepted RFC for the cycle have full guarantee that they will be paid out at the end of the cycle but will still put up their reputation at stake for the next cycle if they are unable to accomplish the work they have accepted in their RFCs in the current one. With short cycles, everyone involved on both sides of the RFC can adjust their tactics quickly, update their private reputation scores looking at delivered work and its quality when starting the next work cycle. TokenDAO does not have to setup streaming contracts or long term vesting contracts like other DAOs and can quickly adjust tactics for how it accepts RFCs from service providers based on observed results and immediate needs. Work is modeled as repeated games. Those who contribute with maximum efficiency in a cycle increase their allocation in the next cycle and those who do not meet their own work targets drop off from subsequent distributions. Everyone is welcome to make their own private reputation calculations and use the information to negotiate for the next cycle(s).

Work Cadence

Work cadence over a year is setup as a series of work cycles setup that pay out TKN incentives and cooldown periods in between. A maximum of 3 work cycles with each set to a 15 week duration is recommended per year and about 1 week or more of a cooldown period before the start of the work cycle to allow RFCs to be setup by TokenDAO.

TokenDAO Possibilities

An organization today typically manages multiple usernames across many SaaS products along with their primary domain name to enable users to access a wide range of assets and portals. A blockchain virtual machine offers general purpose durable storage and compute services, allowing a token symbol to point at a number of services simultaneously, both centralized, such as IP addresses and usernames, and decentralized, such as tokens and smart contract addresses, without running a server.

The token symbol and data stored on-chain can be used by an organization to:

- point to a web domain (with browser extensions)

- point to organizations’ git repos

- point to code packages published by an organization

- point to social media channels and community forums

- point to an organization’s financial data, such as its stock price, trading volume, etc.

In a secure manner, users can resolve a variety of URLs in a variety of contexts without trusting intermediaries by using a token symbol. For all sizes of organizations and communities- both within and outside crypto- TokenDAO will assemble all these pointers under a single name or symbol, permanently under the community control, permanently for free. With the right incentives, TokenDAO can build a large and valuable dataset that can be trusted by all brands, companies, and communities. As developers can build on top of a curated on-chain dataset of names and associated data, many new opportunities arise.

Open Token Trackers

A token tracker is a valuable tool that serves as a gateway to the financial universe. It provides key data such as prices, market caps, total value locked, total supply, etc. TokenDAO can assemble the base dataset that can be used to power many token trackers across a wide range of verticals. In contrast to opaque submission forms on centralized websites like CoinGecko that make it difficult or impossible for users to update token information on their centralized dataset, tkn.xyz shows how a decentralized token tracker can safely add an open edit button. With the TokenDAO dataset, incentives can be designed to supercharge the edit button.

With the TokenDAO dataset, incentives can be designed to supercharge the edit button not only on tkn.xyz but many more vertical token trackers that are yet to be built over the dataset. By helping quickly assemble changes submitted by anyone to any token name on the blockchain, the token community can effectively filter the updates to eliminate spam and errors in a transparent manner until they are deemed safe to publish. Additionally, TKN work incentives could be used to build token tracker interfaces across multiple verticals.

Decentralized token lists

A token list is an effective method of categorizing and packaging token symbols for easy consumption by web apps and smart contracts. In addition to maintaining datasets for token symbols, TKN incentives can also be used to curate token symbols into decentralized token lists. TokenDAO’s primary goal can be very straightforward- maintaining a scam-free token list on-chain that products like Decentralized Exchanges (DEXs) can incorporate securely without having to do the continuous monitoring themselves or trusting a centralized provider like Coingecko.

Incentives can be set up for curating token lists, transparent selection criteria can be used, and discussions can be held openly. The token lists are published on-chain to eliminate any centralized failure points. Because the data is present on-chain, smart contracts like DEXes or Lending protocols can also be setup to automatically allow users to interact with tokens that appear in a particular token list. By eliminating the need for governance within them to update their own list of supported token symbols continuously, they may become more autonomous. TokenDAO can create incentives that solve this problem once and for all, for the shared benefit of all projects.

Long tail assets

Getting the cryptosphere to achieve its full potential requires securing our token name management processes in advance of the next million assets being deployed on-chain in the coming years. This is an immediate need. TN incentives can be targeted as crypto’s adoption improves, so those who deploy or learn about an asset on-chain can quickly establish its presence within the TNS namespace in the quickest manner possible. The most efficient and fastest way to maintain the token symbols for the long tail of assets would be to combine incentives with the open and transparent TokenDAO process.

Secure Name Resolution

Due to the lack of open processes, centralized providers such as Google Search are unable to keep up with scams. Users searching for token names get scammed with scam links embedded in the ads they serve. When users enter domain names incorrectly they end up on phishing sites. Having unique names that resolve to token assets everywhere- in the browser, wallets, et cetra- is beneficial to everyone. Short and unique names make the resolution process more secure and less error-prone. Phishing websites cannot target users who have made a typo with short names.

TokenDAO incentives are critical to ensuring service providers process token symbol updates in a transparent manner. This is done with multiple independent checks and balances in the token name dataset. As a result of TokenDAO incentives users could resolve the information they need in browsers, wallets, or web applications using token symbols present in TNS while receiving a baseline level of security.

Summary

By incentivizing Token DAO participants to do the continuous monitoring work, TKN will help TNS reach consensus among token symbols, maintain a comprehensive database of information for each token symbol, enforce the rules and processes of TNS, neutralize name squatters, and filter out erroneous or malicious updates through open and transparent processes allowing users to reap maximum benefits from the public good name service.